🏢 ALEXANDRIA REAL ESTATE: Derivatives Trading 🏢

Alexandria Real Estate [ARE] is a real estate investment trust (REIT) that invests in properties leased to tenants in the life science and technology industries. The recession fears had made that the sector falls, nevertheless, as Joel Padilla posted, Real Estate could be a nice time to trade [ https://lnkd.in/gdyXiS_w ]

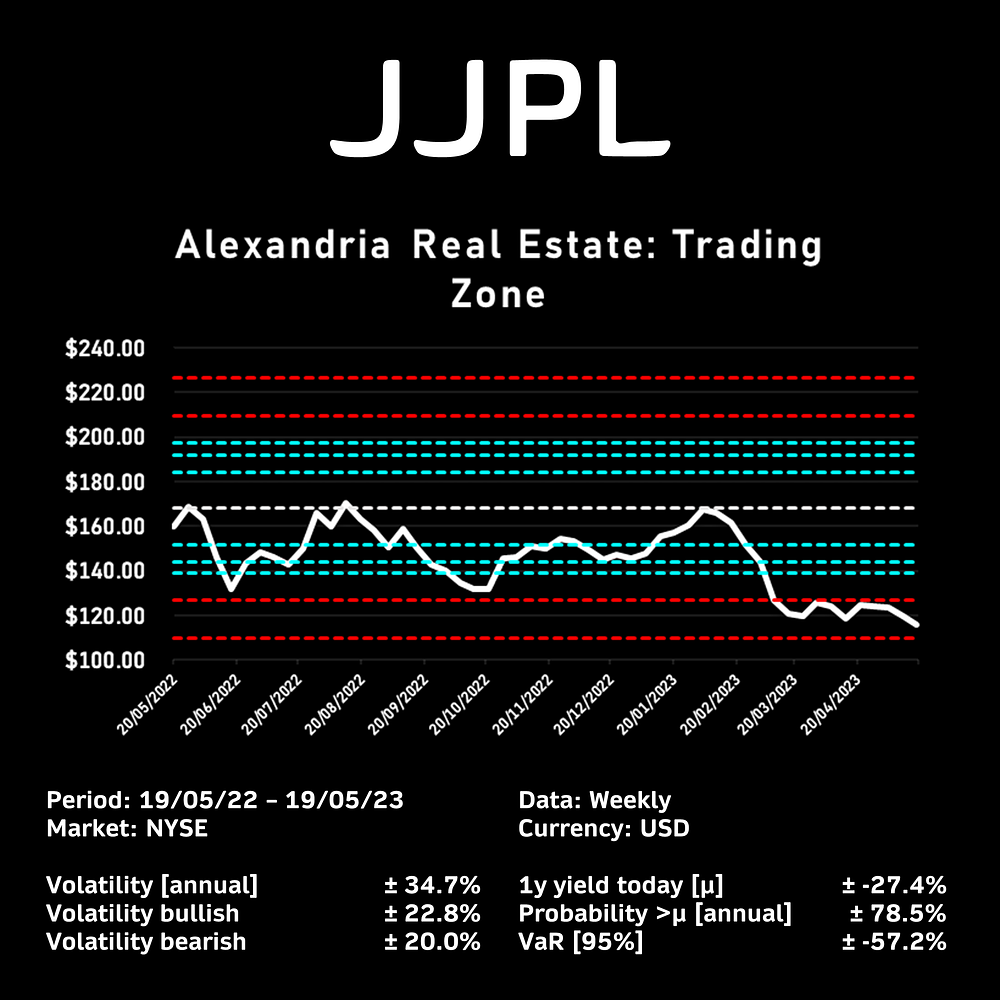

From a technical view, ARE might be ready to drop to the next support at ± $109 USD. However, it could be a false signal and to look for ± $103 USD. In contrast, his next resistance would be in ± $131.5 USD and ± $149 USD. In that sense, an example of some positions could be:

- Put (sell): $103 USD

- Call (buy): $124 USD

- Call (sell): $153 USD

It is relevant to say that the real estate sector could move slowly compared to other stocks, and the risk is a big delay in the movements. The positive is the growing dividend and a high quality in your real estate assets. Finally, everything below ± $114 USD seems good accumulation.

The best analysis is yours!

J. Joel Padilla

https://www.linkedin.com/in/joelpadilla/recent-activity/

Comentarios

Publicar un comentario