🎲 S&P500: PROBABILITIES OF APPRECIATION 🎲

The outlook seems bleak and dark. The core inflation looks harder to destroy, the 10y-2y Bonds curve is inverted (suggesting a recession), the central banks have not said that they will pause the rate hikes (they could be lying), some banks have bankrupt (exceeding losses in 2007), the era of economic expansion is over (rates will not return to 0%) and current geopolitics bets on multipolarity and nationalisms (pro-inflationary model).

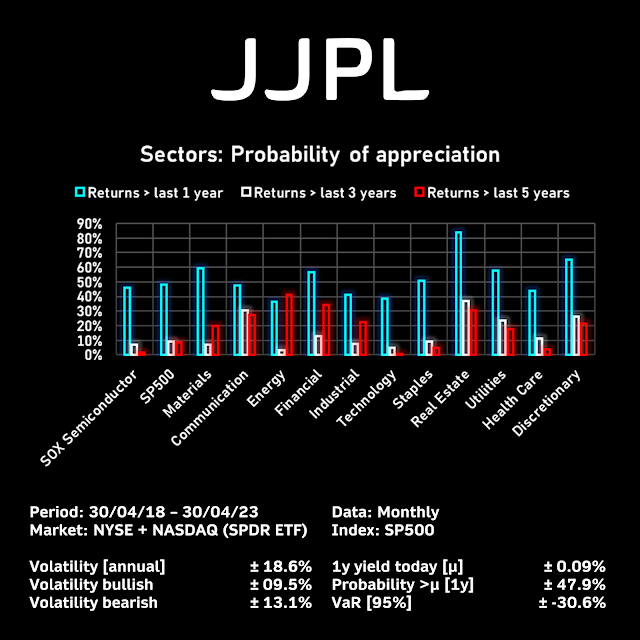

Everybody is looking for a capitulation. Everything smells like the spirit of the 70-80s. However, there are differences y might be opportunities. From a probabilistic perspective, there are sector with >50% of appreciation in the next year: Real Estate, Discretionary, Utilities, Materials and Financials. Of these, Materials and Staples have a divergence with a high probability in the year, but very low in the next 3-5 years. Also, Energy has a divergence between the odds of 3y vs 1-5y; it may be that being now is somewhat risky in the medium term.

Only Real Estate, Communication and Discretionary have better odds on all the time frames. Perhaps, the best of the Communication, Discretionary, Semiconductors and Technology 1-year appreciations has passed, as I warned you in last post [ https://lnkd.in/dkYMKmwA ].

Each decision must consider the quarterly reports of each company. Likewise, the update will be published next quarter, unless there is a relevant event that drastically distorts the calculations.

The best analysis is yours!

Copyright: Joel Padilla 2023

The outlook seems bleak and dark. The core inflation looks harder to destroy, the 10y-2y Bonds curve is inverted (suggesting a recession), the central banks have not said that they will pause the rate hikes (they could be lying), some banks have bankrupt (exceeding losses in 2007), the era of economic expansion is over (rates will not return to 0%) and current geopolitics bets on multipolarity and nationalisms (pro-inflationary model).

Everybody is looking for a capitulation. Everything smells like the spirit of the 70-80s. However, there are differences y might be opportunities. From a probabilistic perspective, there are sector with >50% of appreciation in the next year: Real Estate, Discretionary, Utilities, Materials and Financials. Of these, Materials and Staples have a divergence with a high probability in the year, but very low in the next 3-5 years. Also, Energy has a divergence between the odds of 3y vs 1-5y; it may be that being now is somewhat risky in the medium term.

Only Real Estate, Communication and Discretionary have better odds on all the time frames. Perhaps, the best of the Communication, Discretionary, Semiconductors and Technology 1-year appreciations has passed, as I warned you in last post [ https://lnkd.in/dkYMKmwA ].

Each decision must consider the quarterly reports of each company. Likewise, the update will be published next quarter, unless there is a relevant event that drastically distorts the calculations.

The best analysis is yours!

Copyright: Joel Padilla 2023

Comentarios

Publicar un comentario