🎰 SP500: PROBABILITIES OF APPRECIATION 🎰

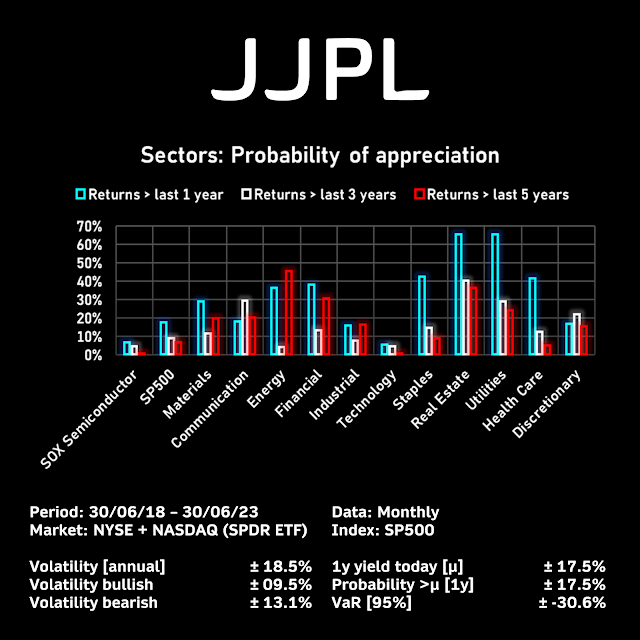

At the time I warned you of the potential of the Tech and Semiconductor sector (https://lnkd.in/ekZkBzYX), the Discretionary and Communication sector (https://lnkd.in/dkYMKmwA) and the Real Estate sector (https://lnkd.in/gdyXiS_w). In this time, according with JJPL Index, only the Real Estate and Utilities sector have the best probabilities of appreciation with the best risk-reward ratio.

Real Estate and Utilities have higher probabilities in the short (1y), medium (3y) and long term (5y). In addition, the Energy and Financial sectors may be interesting options for the short and long term. Especially the Energy sector, must be in the sight of any trader and investor because is very volatile. However, in both cases, the recommendation is being very tactical with the companys; not all have the same potential and some could be a trap.

In the medium term, the Communication and Discretionary (be careful because this sector is wide and volatile) sectors have a nice momentum. At least they aren't overheated like the Semiconductor, Tech, and some Industrial sectors. In the short term, Staples and Health Care could be an acceptable option, especially if the market decides to take a rest pause, has a pullback, or rotate the portfolio to coolest sectors.

The best analysis is yours!

J. Joel Padilla

https://jjoelpadilla.wixsite.com/jjpl-index

Copyright: Joel Padilla 2023

Real Estate and Utilities have higher probabilities in the short (1y), medium (3y) and long term (5y). In addition, the Energy and Financial sectors may be interesting options for the short and long term. Especially the Energy sector, must be in the sight of any trader and investor because is very volatile. However, in both cases, the recommendation is being very tactical with the companys; not all have the same potential and some could be a trap.

In the medium term, the Communication and Discretionary (be careful because this sector is wide and volatile) sectors have a nice momentum. At least they aren't overheated like the Semiconductor, Tech, and some Industrial sectors. In the short term, Staples and Health Care could be an acceptable option, especially if the market decides to take a rest pause, has a pullback, or rotate the portfolio to coolest sectors.

The best analysis is yours!

J. Joel Padilla

https://jjoelpadilla.wixsite.com/jjpl-index

Copyright: Joel Padilla 2023

Comentarios

Publicar un comentario