🥋 NEARSHORING: JAPAN 🥋

The outflow of investment and capital from China will profit not only to Mexico, but other regions such as Latin America, South Asia and the best allied against China after the WW II: Japan. However, there was a trouble in this country.

After 90s crisis by a real estate and financial bubble, the country stagnated because of its culture. In Japan, the corporate culture requires high liquidity (due to crises) and no shareholder remuneration (via dividends or share buy-backs). Besides, the problem is promotions in companies (based on seniority, not ability), the ageing of the population, their full employment and the rejection of foreigners. However, out of necessity and not for the sake of it, this will change.

Acceptance of buybacks and reduced liquidity have boosted the Nikkei with highs expectations. US and Europe need to put their capital, and Japan appears to be a new hub for semiconductors and other strategical tech-commodities, as well as ally [ Alliances: Towards WWIII ]. Geopolitical readaptation will require social and employment changes in order to survive. Besides, Japan has large companies that have dominated the technological and industrial world.

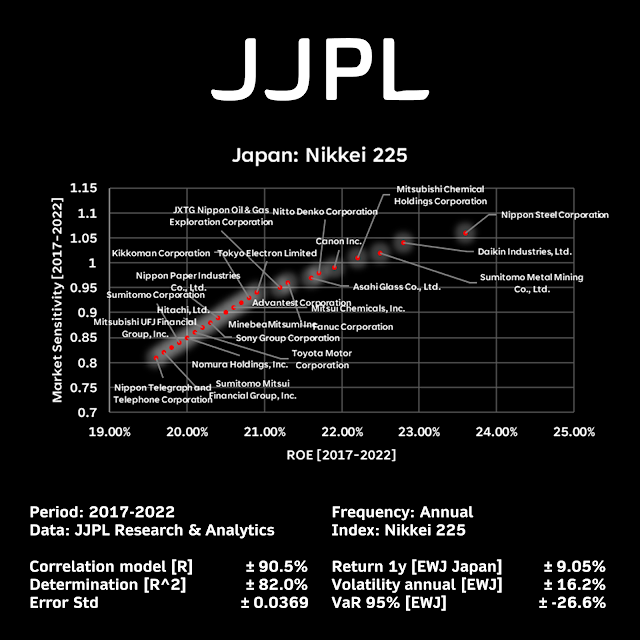

The chart shows an example of the 25 enterprises with the highest average ROE from 2017 to 2022, against their Beta with NIKKEI 225. In this case, ROE explains ± 82% of the times the BETA behaviour, with ± 90.5% of correlation and an error standard of ± 0.037. It is worth mentioning that the valuation process for Japanese equities may differ from Western equities. In some cases, the best ratios could be Price to Book. However, it could change if the Wester influence come back. The most important is putting on the table the relevance that Japan will play.

The best analysis is yours!

J. Joel Padilla

Copyright: Joel Padilla 2023

Comentarios

Publicar un comentario