✈️ VOLARIS: DERIVATIVES TRADING ✈️

Controladora Vuela Compañía de Aviación, S.A.B. de C.V., through its subsidiary, Concesionaria Vuela Compañía de Aviación, S.A.P.I. de C.V., provides air transportation services for passengers, cargo, and mail in Mexico and internationally. The company operates approximately 590 daily flights on routes connecting 43 cities in Mexico, 22 cities in the United States, 4 cities in Central America, and 2 cities in South America. As of December 31, 2022, it leased 116 aircrafts and 23 spare engines.

Insights:

- P/S ratio near to 0.2x, where 0.8x has been its mean

- Correlation with MSCI Emerging Markets [EEM] of ≈ 26.6%, where their behaviour only could be explained by ≈ 7.1% in the last year [LTM]

- Beta with MSCI Emerging Markets [EEM] of ≈ 0.90

- Special consideration: VOLARA belongs to an oligopoly where only VIVA AEROBUS and AEROMEXICO are its competitors. Despite its budding authoritarianism, Mexico is ultimately a semi-colony where it appears as a partner in the face of future geopolitical tensions, reducing the risk of any emerging country, except in special situations such as bankruptcy or delisting from the BMV/BIVA.

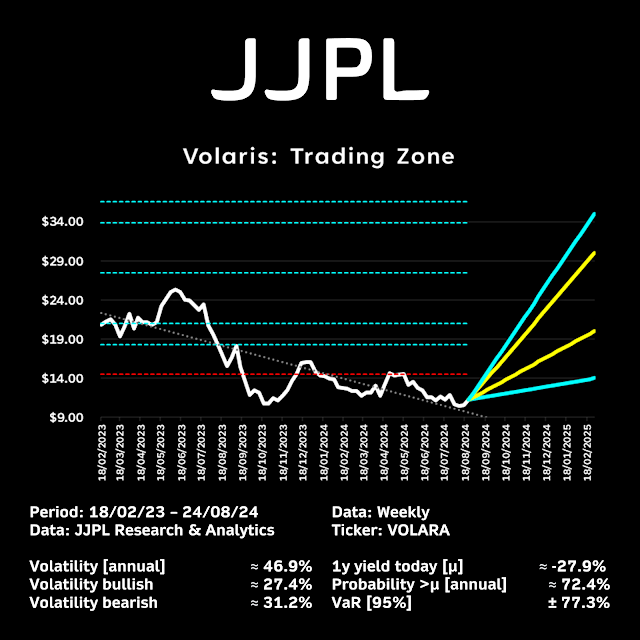

Based on its last EPS [24/08/24 TTM] of ≈ $1.77 MXN and a 15 Forward PER and a sensibility of ± 0.469x annual, a hypothetical spread could be (ceteris paribus):

- High: ≈ $ 39.00 MXN

- Neutral: ≈ $ 26.55 MXN

- Down: ≈ $ 14.09 MXN

Hypothesis:

VOLARA in the next >12 (perhaps 24) months, might have a distribution phase above ≈ $ 32 MXN and an accumulation phase below ≈ $ 14.54 USD where there is a bullish bias due to its revaluation probabilities and other quantitative parameters, assuming not many risk linked to emerging markets instability

Hedge plan example:

- Call [sell]: $38 MXN

- Call [sell]: 532 MXN

- Put [buy]: $20 MXN

- Put [sell]: $14 USD

Risks

- Prices higher than $32 / $38 for a long time

- Prices lower than $14 for a long time.

- The neutral price of $26 is not reached at expiration

- Roll over costs (if time is not well estimated)

The best analysis is yours!

J. Joel Padilla

Copyright: Joel Padilla 2024

Comentarios

Publicar un comentario