📊 ROA, ROE & ROIC vs PROFIT MARGIN 📊

If you want to evaluate in a easy way the company performances against others, there are 3 basic ratios. Each measures a specific component of how profitable and efficient the company is in a given period. In summary, the calculation of these is:

ROA = Net income / Total Assets

ROE = Net income / Equity

ROIC = Net Operating Profit after Taxes / Invested Capital

It all aims to tell the proportion of the company's returns generated by its Total Assets (ROA) and Total Assets minus Total Liabilities (ROE). Perhaps, the most complex is ROIC because there are many methodologies; but, in general terms, it wants to know the proportion of operating returns considered all the money used. In some cases, ROIC and ROCE (EBIT / Capital Employed) is more or less similar.

Having said that, the logical question would be: Does anyone help me to quickly infer what the net margin of my business could be? To solve this problem, it was compared the Q2 2023 (twelve trailing month) data of 50 companies with the common denominator of being strategic and relevant to the national security of any nation.

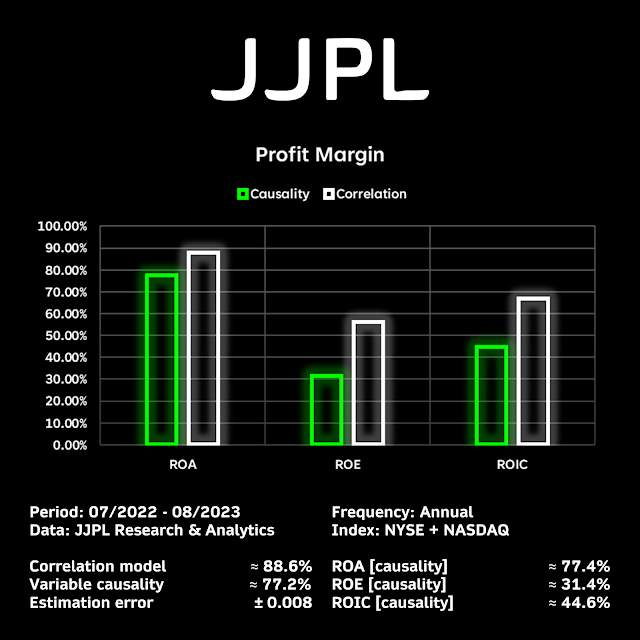

The result shows that ROA correlated best with Net Margin with ≈ 87.99%, and Net Margin is explained by ≈ 77.42% by the behaviour of ROA. The rest of the figures are in the graph. Moreover, if all three variables are considered in one model, they can only explain ≈ 77.17% of the Net Margin, with a ≈ 88.6% correlation and an estimation error of ≈ 0.008x. In other words, ROA was the main and strongest indicator.

The enterprises selected were:

SEMICONDUCTORS

- Nvidia

- TSM

- Broadcom

- AMD

- Intel

- Texas Instruments

- Qualcomm

- Analog Devices

- Micron

- NXP

AEROSPACE & DEFENSE

- Boeing

- Raytheon

- Lockheed Martin

- Northrop Grumman

- General Dynamics

- TransDigm

- L3Harris

- Heico

- Howmet

PHARMACEUTICAL

- Eli Lilly

- Johnson & Johnson

- Merck

- AbbVie

- Novartis

- AstraZeneca

- Pfizer

- Amgen

- Bristol-Myers Squibb

- Gilead

ENERGY

- Exxon

- Chevron

- Shell

- Total Energies

- BP

- Equinor

- Petrobras

- Cameco

- Uranium Energy

- Consol

TELECOMMUNICATIONS

- Comcast

- T-Mobile

- Verizon

- AT&T

- Charter

AGRICULTURAL

- Nutrien

- Corteva

- CF Industries

- Mosaic

- FMC

- Scotts Miracle

This information will undoubtedly be useful for future posts. Many conclusions can be drawn. However, what do you think about?

The best analysis is yours!

J. Joel Padilla

Copyright: Joel Padilla 2023

Comentarios

Publicar un comentario